CTA Resources

Get Started Today!

Welcome to the Corporate Transparency Act (CTA) Resources Page

This repository serves as your gateway to understanding the complexities of the CTA, legislation that signifies a major shift in business reporting requirements that began January 1, 2024. Our objective is to provide you with a rich array of resources that offer insights into compliance, the importance of timely filings, and strategies for maintaining your business’s legal standing. Empower your business with the knowledge and tools necessary for adhering to the CTA’s mandates. AS OF MARCH 21, 2025, even though the CTA remains law, enforcement has been limited to foreign reporting companies only. Any other BOIR filings by domestic reporting companies are strictly voluntary.

March 2, 2025 Update: All nonexempt reporting companies SUBJECT TO CTA ENFORCEMENT (foreign domestic reporting companies only) must file their initial Beneficial Ownership Information Report (BOIR) by APRIL 25, 2025. All businesses subject to CTA enforcement that are created after March 26, 2025, have thirty (30) calendar days from the date of registration to file their initial BOIR. NONEXEMPT FOREIGN REPORTING COMPANIES are still subject to CTA enforcement.

Short Videos

The Videos provided below were created prior to the March 21, 2025 changes to enforcement of the CTA. They should be used for information about the mechanics of complying with the law as those remain accurate for reporting companies still subject to enforcement, but any filing deadlines mentioned should be disregarded. Always check our BLOG or the IMPORTANT UPDATES TO THE CTA section below for the most up-to-date information on the CTA.

Important Updates to the Corporate Transparency Act (CTA)

The deadline for all nonexempt reporting companies STILL SUBJECT TO CTA ENFORCEMENT (foreign reporting companies only) to file an initial Beneficial Ownership Information Report (BOIR) is April 25, 2025. Nonexempt foreign reporting companies that do not report their non-U.S. persons beneficial owners or otherwise comply with the CTA are STILL subject to civil fines of $606/day and other criminal penalties.

APRIL 25, 2025

Mandatory deadline for nonexempt foreign reporting companies to file their initial BOIRs, but there is no requirement to report their beneficial owners that are U.S. Persons.

April 25, 2025 is the deadline for nonexempt foreign reporting companies created before March 26, 2025, to file their initial BOIR (Beneficial Ownership Information Report). Beneficial owners of those foreign reporting companies that are U.S. persons do not need to be reported or provide their beneficial ownership information to the foreign reporting company. Any new nonexempt foreign reporting company created after March 26, 2025, has thirty (30) calendar days from the date of registration to file its initial BOIR. Changes to any existing BOIR for reporting companies subject to enforcement of the CTA must be made within thirty (30) calendar days of the change.

March 21, 2025

FinCEN issues interim final rule stating that there will be no CTA enforcement against domestic reporting companies and U.S. Persons.

FinCEN issued an Interim Final Rule indicating that no domestic reporting company or U.S. person would be subject to the enforcement of the CTA. The CTA remains law, but FinCEN and the Dept. of Treasury are not going to enforce it against domestic reporting companies or U.S. persons that are beneficial owners of a foreign reporting company. Any filing of BOIRs by domestic reporting companies or U.S. persons is strictly voluntary. Nonexempt foreign reporting companies have until April 25, 2025, to file their initial BOIR. The “Interim Final Rule: Questions and Answers” authored by FinCEN may be found at https://www.fincen.gov/boi/ifr-qa.

March 2, 2025

The U.S. Department of Treasury will not enforce the CTA against domestic reporting companies and U.S. Citizens.

On March 2, 2025, the Department of Treasury issued a press release stating that it would not enforce the Corporate Transparency Act (CTA) against domestic reporting companies or U.S. Citizens regardless of any regulation changes made by FinCEN. This means the Dept. of Treasury is only selectively enforcing the CTA, but that does not invalidate it, nor does it change the March 21, 2025 deadline. FOREIGN REPORTING COMPANIES and NON-U.S. CITIZENS will still be subject to the enforcement of the CTA (which includes civil fines of $606/day and other penalties).

February 19, 2025

FinCEN extends the mandatory filing deadline to March 21, 2025

After the preliminary injunction in the Smith case is stayed (stopped), FinCEN announces that all nonexempt reporting companies have thirty (30) days to file, update or correct their Beneficial Ownership Information Reports (BOIRs). The new mandatory deadline is March 21, 2025. Read the alert from FinCEN.

February 17, 2025

Judge grants the new administration’s request to stay the preliminary injunction in the Smith case

The Judge stays (stops) the preliminary injunction in the Smith case allowing the enforcement of the Corporate Transparency Act (CTA) to proceed. He bases his stay on the U.S. Supreme Court’s stay of the preliminary injunction in the Texas Top Cop Shop case.

February 7, 2025

The new administration files Opening Brief in Texas Top Cop Shop 5th Circuit Appeal signaling the continued pursuit of enforcement of the CTA

The new administration has filed its Opening Brief in the expedited appeal of the Texas Top Cop Shop case. Oral arguments on this matter are scheduled for March 25, 2025 in the 5th Circuit Court of Appeals.

February 5, 2025

The new administration files Notice of Appeal and Request for Stay in the Eastern District of Texas Smith case

The government requested a stay (stop) of the preliminary injunction imposed and still in force in the Smith case. Once the court rules on the request (likely after the Plaintiffs have had the opportunity to respond), the enforcement of the CTA will either go into effect or if not, the government will likely request a stay from the U.S. Supreme Court as it did in the Texas Top Cop Shop case.

January 23, 2025

U.S. Supreme Court stays (stops) the preliminary injunction in Texas Top Cop Shop case

On January 23, 2025, the U.S. Supreme Court stayed (stopped) the Texas Top Cop Shop preliminary injunction. However, because there is a preliminary injunction in effect from the Smith case (also out of the Eastern District of Texas) the deadline for filing Beneficial Ownership Information Reports (BOIRs) remains on hold. However, this tells us two things: 1) the U.S. Supreme Court found that there is a substantial likelihood that the CTA will be held constitutional; and 2) the U.S. Supreme Court will likely stay (stop) the preliminary injunction in the Smith case if the government asks.

January 17, 2025

Civil fines for failure to comply with the CTA increased to $606/day

Civil penalties for adjusted for all FinCEN regulations as part of the annual adjustment to account for inflation. Civil fines for violation of the CTA were increased from $591/day to $606/day.

January 7, 2025

Eastern District of Texas Court issues a preliminary injunction against the enforcement of the CTA

A judge in the Eastern District of Texas issued a preliminary injunction against the enforcement of the CTA (Smith v. U.S. Dept. of Treasury). This is an additional impediment to the enforcement of the CTA. It will preclude mandatory filings even if the U.S. Supreme Court grants the stay in the Texas Top Cop Shop case.

December 31, 2024

The U.S. Solicitor General (on behalf of the Department of Treasury) applies to the U.S. Supreme Court for a stay (stop) of the preliminary injunction issued by the 5th Circuit Court of Appeals.

December 26, 2024

The 5th Circuit Court of Appeals reverses its December 23, 2024, stay (stop) in the Texas Top Cop Shop case and puts the enforcement of the CTA on pause again.

December 24, 2024

FinCEN extends the deadline to file BOIRs to January 13, 2024.

December 23, 2024

The 5th Circuit Court of Appeals grants a stay to the preliminary injunction against enforcement of the CTA

The 5th Circuit Court of Appeals grants the stay (stop) of the preliminary injunction in the Texas Top Cop Shop case which reimposes the original December 31, 2024 deadline for CTA compliance.

December 3, 2024

The enforcement of the Corporate Transparency Act temporarily suspended

A Judge in the Eastern District of Texas issues a preliminary injunction in the Texas Top Cop Shop case. This temporarily pauses the enforcement of the CTA.

October 2024

Spouses in community property states may have to report.

- Arizona, Nevada and California are community property states so anything your spouse owns, you own unless you have properly taken steps to disclaim business interests.

- You should obtain a legal opinion on your specific situation to be sure that you properly comply with the CTA.

July 2024

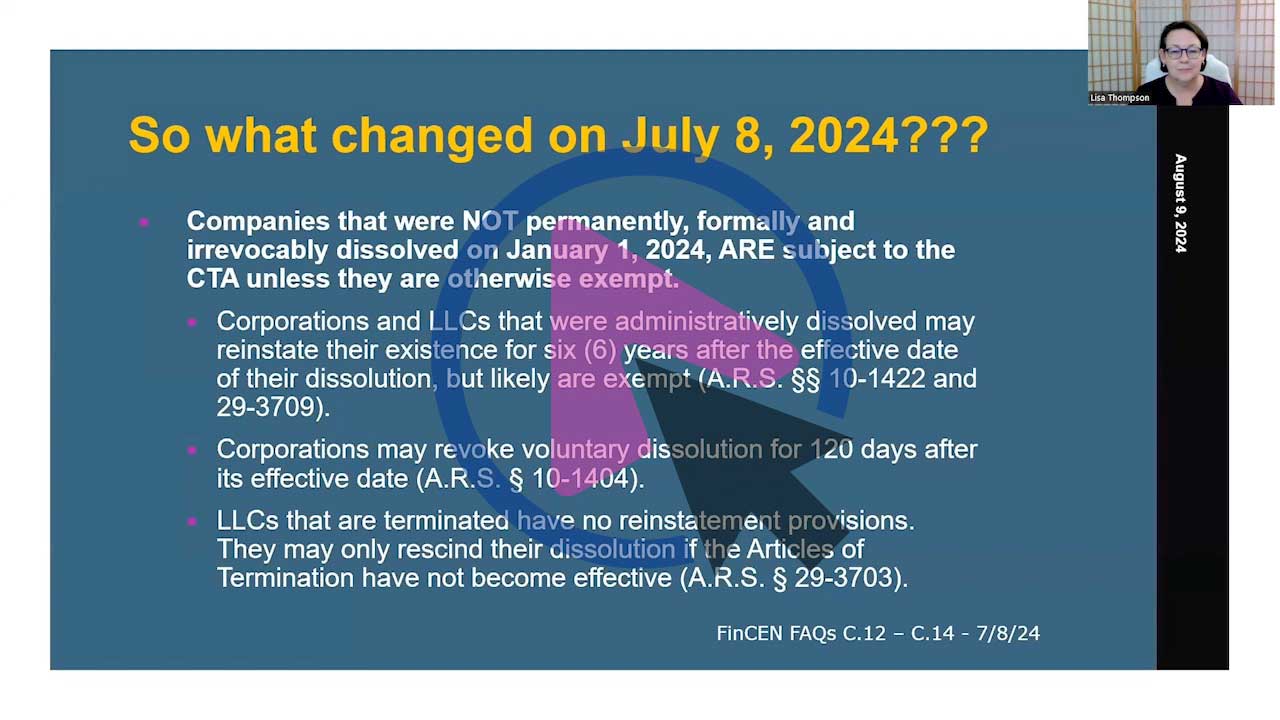

Dissolved companies may still have to report.

- All business entities that were not completely and irrevocably formally dissolved by January 1, 2024, and dissolved during 2024, must still file a BOIR by December 31, 2024, unless they are otherwise exempt.

- You should contact us to see how this new guidance affects your dissolved business.

Important Dates & Timeframes

March 21, 2025

- Nonexempt foreign reporting companies must file their initial Beneficial Ownership Information Report (BOIR) with FinCEN by April 25, 2025. Foreign reporting companies do not have to report any beneficial owners that are U.S. persons and U.S. persons do not have to provide their beneficial ownership information to foreign reporting companies.

- ANY new nonexempt foreign reporting company created after March 26, 2025, has thirty (30) calendar days to file its initial BOIR. Foreign reporting companies subject to CTA enforcement do not have to report the beneficial ownership of any U.S. person and no U.S. person must provide their beneficial ownership information to any foreign reporting company.

30 Calendar Days

- Any foreign reporting company created after March 26, 2025, has thirty (30) calendar days to file its initial Beneficial Ownership Information Report (BOIR) with FinCEN.

- If anything changes on or a correction needs to be made to a Beneficial Ownership Information Report (BOIR) after it has been filed, the reporting company has thirty (30) calendar days to update the report if it is subject to CTA enforcement.

Frequently Asked Questions (FAQs)

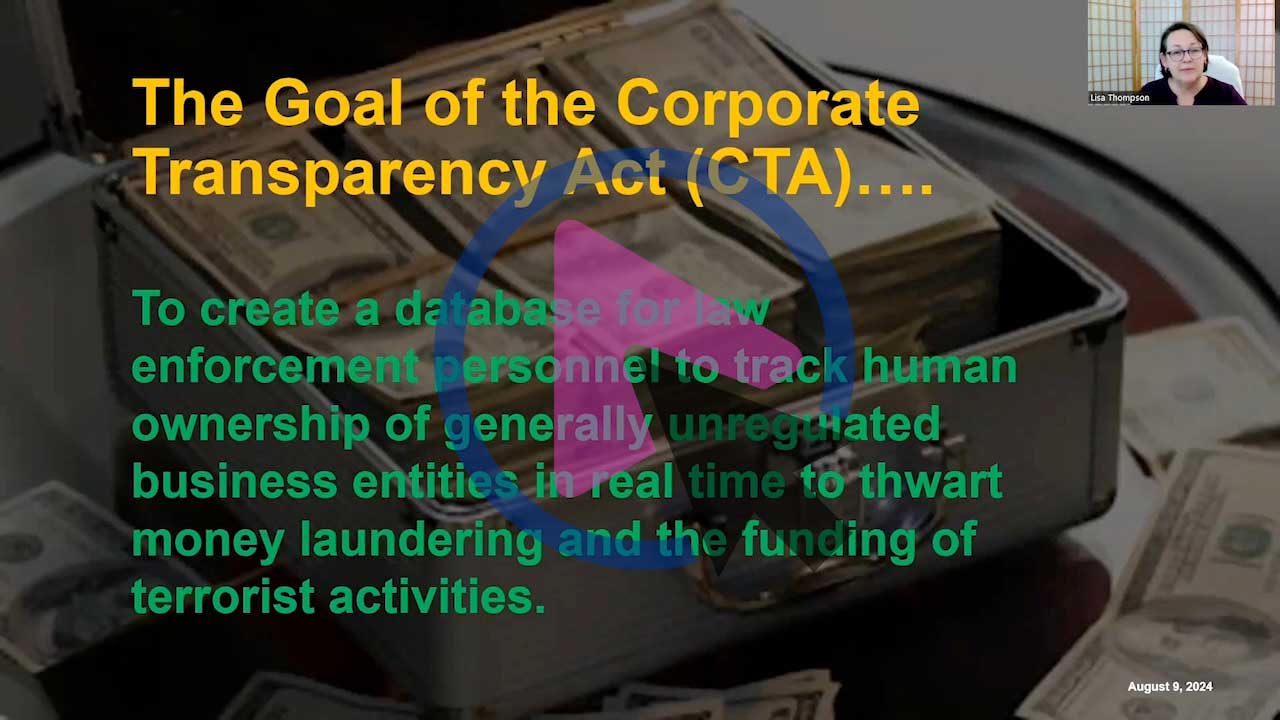

Corporate Transparency Act Basics and Definitions

The Corporate Transparency Act is a bi-partisan federal law passed by 2/3 of U.S. Congress on January 1, 2021. It is designed to enhance transparency in business ownership to combat money laundering, terrorism and other illicit activities by having businesses report their HUMAN ownership information to FinCEN in a Beneficial Ownership Information Report (BOIR). The purpose of the CTA is to create a non-public database to assist law enforcement in the investigation of money laundering, terrorist activities and other matters of national security in real time.

FinCEN is the Financial Crimes Enforcement Network, and it is a bureau of the U.S. Department of Treasury (just like the IRS). FinCEN’s mission is to safeguard the financial system from illicit use, combat money laundering and terrorism and to promote national security through strategic use of financial authorities and the collection, analysis, and dissemination of financial intelligence.

Any foreign or domestic reporting company, as defined by the CTA, must file a Beneficial Ownership Information Report (BOIR) with FinCEN that contains the company’s identifying information as well as its beneficial owners’ personal identifying information. The BOIR must remain updated as company and ownership information changes. Any updates to BOIRs must be made within thirty (30) calendar days of any change.

The Beneficial Ownership Information Report (BOIR) is the document that provides the reporting company’s information to FinCEN as well as the Personal Identifying Information (PII) of the company’s beneficial owners. BOIRs may only be filed online on FinCEN’s Beneficial Ownership platform. Third party companies like us can file the report and store your information confidentially for you.

Beneficial owners must provide their Personal Identifying Information (PII) to FinCEN. Sounds scary, but it is not. You provide more information to the IRS on your tax returns. Essentially, Beneficial Owners (and sometimes their spouses) must provide a copy of an unexpired passport/driver’s license, their home address and their date of birth.

Failure to file a BOIR or keep it updated may result in civil fines of $606/day (no cap) and criminal penalties of a maximum of a $10,000 fine and up to two (2) years imprisonment. Fines may be assessed against the reporting company as well as the company’s beneficial owners PERSONALLY.

As of March 21, 2025, only nonexempt foreign reporting companies are subject to CTA enforcement and their initial Beneficial Ownership Information Reports (BOIRs) must be filed by April 25, 2025. ANY new nonexempt foreign reporting companies created after March 26, 2025, have thirty (30) calendar days to file their BOIR. Foreign reporting companies subject to CTA enforcement do not have to report the beneficial ownership of any U.S. person and no U.S. person must provide their beneficial ownership information to any foreign reporting company.

On March 2, 2025, the Department of Treasury issued a press release stating that it would not enforce the Corporate Transparency Act (CTA) against domestic reporting companies or U.S. persons regardless of any regulation changes made by FinCEN. On March 21, 2025, FinCEN issued an Interim Final Rule stating that it too would not be enforcing the CTA against domestic reporting companies and U.S. persons. By extension this means that nonexempt foreign reporting companies are still subject to enforcement of the CTA. The new Interim Final Rule also states that nonexempt foreign reporting companies do not need to report and U.S. persons that are beneficial owners on their BOIR and U.S. persons do not need to provide their beneficial ownership information to the foreign reporting company. FinCEN’s Interim Final Rule: Questions and Answers may be found at https://www.fincen.gov/boi/ifr-qa.

If your business is a domestic reporting company, it is not subject to CTA enforcement. However, because the CTA is a law enforcement tool many domestic reporting companies and their owners feel strongly that they want to provide their information in the hope that it will assist in any investigation (keep law enforcement from going down a rabbit hole to figure out that they are legitimate). Other domestic reporting companies and their owners do not want to deal with the uncertainty of the changes to the CTA so they are filing their BOIRs voluntarily. It is up to you, but if you decide not to file a BOIR, be sure you are subscribed to our CTA email updates or have some other source that will send you any updates on CTA enforcement in real time should the enforcement parameters change.

If your business is a domestic reporting company, it is not subject to CTA enforcement. As such, you have no obligation to update your business’ BOIR. However, it would be best practice to do so in case your business becomes subject to enforcement. If your BOIR is up-to-date you would not need to worry about updating it at that time. Also, many of my clients view the BOIRs as an aid to law enforcement so they are maintaining their accuracy even though they are not legally required to do so.

We will keep you updated if you sign up for our CTA emails here OR you can follow our blog, Lisa and the Law.

Challenges to the CTA – Constitutionality

No, none of that is true. There is pending litigation in the Courts of Appeal in the 4th, 6th, 9th, and 11th Judicial Circuits. There also may be appeals filed in the 1st and 6th Circuits, but they have not been filed yet. Only the courts in the 11th Circuit (Texas and Alabama) have issued preliminary injunctions against the enforcement of the CTA. The Courts in the 1st (Maine), 4th (Virginia), 6th (Michigan), 9th (Oregon) Circuits have all denied to issue preliminary injunctions to stop the enforcement of the CTA. The U.S. Supreme Court also stayed (stopped) the preliminary injunction in one of the Texas cases indicating that it found that the CTA was likely constitutional. All of this will play out over time and the U.S. Supreme Court will ultimately rule on the constitutionality of the CTA at some point in the future. Until then, reporting companies must comply with the CTA as it stands. As of February 19, 2025 the deadline to file initial Beneficial Ownership Information Reports (BOIRs) is MARCH 21, 2025.

We don’t know definitively. Only one court has made a final ruling on the constitutionality of the CTA and that ruling has been appealed. The other pending litigation in Maine, Michigan, Oregon, Texas and Virginia is pending. The Maine, Michigan, Oregon and Virginia District Courts declined to issue preliminary injunctions. Two Texas courts issued nationwide preliminary injunctions which temporarily suspended the enforcement of the CTA pending further litigation. The U.S. Supreme Court stayed (stopped) the preliminary injunction in one of the Texas cases indicating that it found that the CTA was likely constitutional. The other preliminary injunction was withdrawn by the Texas judge that issued it. All of this will play out over time and the U.S. Supreme Court will ultimately rule on the constitutionality of the CTA at some point in the future. Until then, reporting companies must comply with the CTA as it stands. As of February 19, 2025, the deadline to file initial Beneficial Ownership Information Reports (BOIRs) is MARCH 21, 2025.

A “preliminary injunction” stops the Defendants from doing something (also called enjoining). Essentially, a judge issues a preliminary injunction to maintain the status quo until there is a final ruling on the lawsuit. If the Plaintiffs (people bringing the lawsuit) win, the preliminary injunction becomes permanent. If the Plaintiffs lose, the preliminary injunction is terminated, and the Defendants are no longer enjoined from taking action.

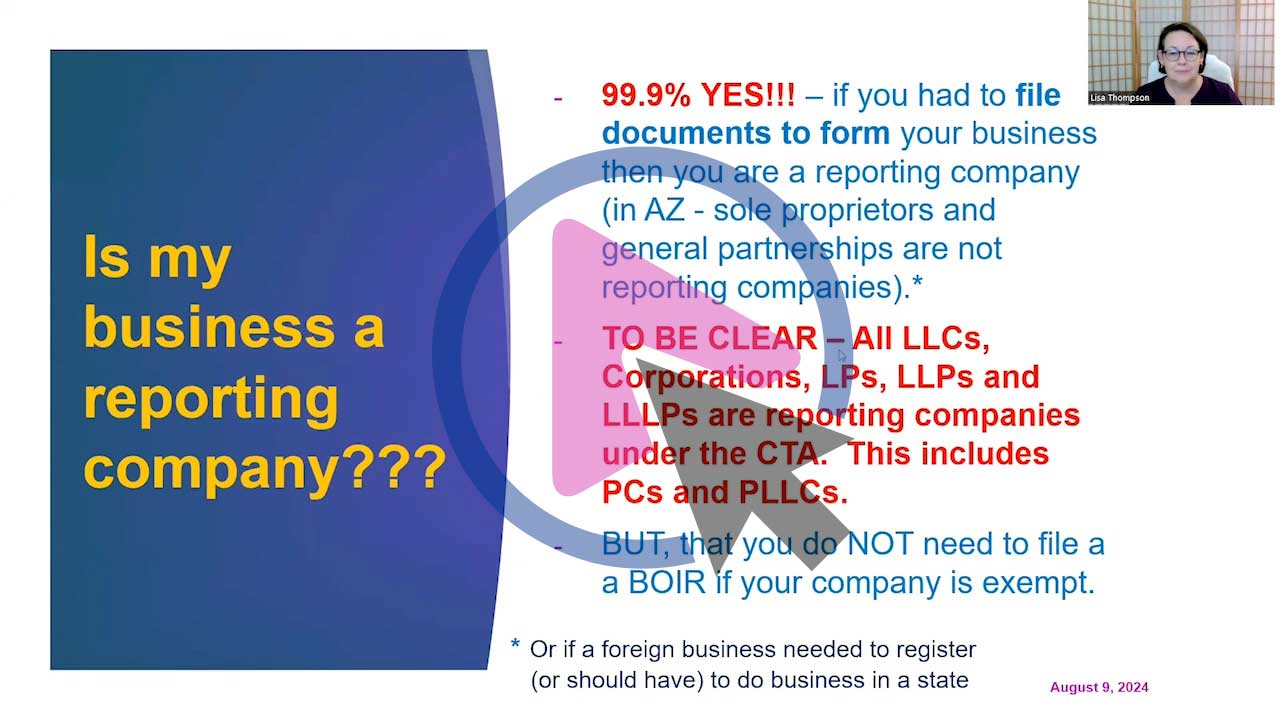

Reporting Companies Under the Corporate Transparency Act (CTA)

A “reporting company” is any company that was created by filing or registering a document with the Secretary of State or Corporation Commission/Tribe or the equivalent in the U.S. Filing and registration requirements for businesses may vary by state so in some states like Delaware, a general partnership might be a reporting company whereas in Arizona it would not. Entities created in a U.S. Territory or under Tribal Law are also reporting companies.

A foreign reporting company is any business entity (including a corporation or LLC) formed under the law of a foreign country that have registered to do business in the U.S. by the filing of a document with a Secretary of State or any similar office. If the foreign company is not required to register to do business where it is doing business in the U.S., it is not a reporting company. However, most states require that non-U.S. companies register to do business in the state in order for them to legally do so. Foreign reporting companies must also comply with the CTA unless they are otherwise exempt.

Yes, probably. Unless you are a sole proprietorship or a general partnership (both of which require no filing of paperwork to form) in most jurisdictions, your business is a reporting company. The real question is whether your business is exempt from reporting under the CTA or not. Keep in mind that the definition of reporting company may vary by state, so it is important that you seek legal advice with any questions. Business entities formed in U.S. Territory (Commonwealth of Puerto Rico, the Commonwealth of the Northern Mariana Islands, American Samoa, Guam, and the U.S. Virgin Islands) or business entities formed in accordance with Tribal law are also reporting companies.

Any foreign or domestic reporting company must file a Beneficial Ownership Information Report (BOIR) with FinCEN (and keep it updated) unless the reporting company is otherwise exempt. Almost all companies operating in the U.S. are reporting companies, but those that are already heavily regulated, typically, are exempt. If a company loses its exemption at any point, it must file a BOIR with FinCEN.

Probably not. It is rare that a state requires that a sole proprietor register to with the Secretary of State or Corporation Commission to exist or do business.

If you are a sole proprietor and you did not have to file any documents with the Corporation Commission or Secretary of State to create your sole proprietorship, you are not a reporting company and do not have to file a BOIR with FinCEN. Having a business license, EIN or a trade name does not create a sole proprietorship so having a business license, EIN or registering for a trade name by themselves do not trigger reporting requirements under the CTA.

It depends. Taxation of a company is not part of the analysis to determine whether a company must file a BOIR with FinCEN under the CTA. If you are a reporting company, you must report to FinCEN unless you are otherwise exempt. The taxation of your business entity does not matter.

YES, unless the LLC meets the qualifications of one of the 23 exemptions of the CTA.

NO, unless the PLLC meets the qualifications of one of the 23 exemptions of the CTA.

Exemptions from CTA Reporting

There are twenty-three (23) exemptions to the reporting requirements of the CTA. A company may be a reporting company, but it may not have to file a Beneficial Ownership Information Report (BOIR) because it is exempt (unless it loses its exemption status). Typically, reporting companies that are already heavily regulated (like banks, credit unions, insurance companies, etc.) are exempt. However, there are exemptions for businesses that are not heavily regulated as well. The three (3) most common exemptions are the: large operating company exemption; tax-exempt entity exemption and the inactive entity exemption.

The “large operating company exemption” exempts any reporting company that has 20 full-time employees (not hybrids, not independent contractors, but full-time employees), regularly conducts business at a physical location in the U.S. and has filed a tax return with annual gross receipts of $5 million or more from filing a Beneficial Ownership Information Report (BOIR) with FinCEN. However, if any of these things change, the company must file a BOIR with FinCEN. The deadlines for filing a BOIR for a company that has lost its exemption status vary by circumstance so contact counsel immediately so that the filing deadline is not missed. If a foreign reporting company is seeking to use this exemption, there are additional requirements to consider. Please seek specific legal advice to ensure proper use of this exemption.

Your organization may be eligible for the TAX-EXEMPT ENTITY exemption. Generally, tax-exempt entities that are described under 501(c) of the Internal Revenue Code of 1986 (IRS Code) and exempt from tax under 501(a) of the IRS Code are exempt from reporting under the tax-exempt entity exemption of the CTA. In some instances, an entity assisting a tax-exempt entity may also be exempt from reporting to FinCEN. Please seek specific legal advice if you believe that you may not have to report under the entity assisting a tax-exempt entity exemption to be sure you qualify.

Yes. Until such time as the new nonprofit entity has obtained tax-exempt status from the Internal Revenue Service (IRS), it is not an exempt entity under the CTA. It must file its BOIR in accordance with any deadlines set by FinCEN until such time as it obtains its tax exempt status in writing from the IRS. Once the nonprofit entity obtains its tax-exempt status (typically 501(c)(3)) from the IRS and it meets the requirements of the tax-exempt entity exemption, it should amend its BOIR to indicate that it is exempt. If the nonprofit organization ever loses its tax-exempt status, it will have to report to FinCEN within thirty (30) calendar days of losing its tax-exempt status.

Yes, if the nonprofit entity does not have its tax-exempt status approval from the Internal Revenue Service (IRS) by any deadline to file a BOIR. Once the nonprofit entity obtains its tax-exempt status (typically 501(c)(3)) from the IRS and it meets the requirements of the tax-exempt entity exemption, it should amend its BOIR to indicate that it is exempt.

Maybe. It depends. If the HOA was formed by filing a document with the Arizona Corporation Commission or the California/Nevada Secretary of State, it is a reporting company. However, it may exempt from filing a Beneficial Ownership Information Report (BOIR) with FinCEN if it meets the requirements of a tax-exempt organization. This means that it applied for and received tax exempt status under IRS Code 501(C)(4) or the equivalent. If not, the HOA must file a BOIR. If there are questions about your HOA’s tax exempt status, seek advice of legal counsel as any of the $591/day fines assessed by FinCEN will be assessed against the Board of Directors and Officers of the HOA personally.

You may be eligible for the INACTIVE ENTITY exemption. If a business was formed prior to January 1, 2020, and is not currently engaged in business, has had no change in ownership or received funds in an amount greater than $1,000 in the last 12 months, is not owned by a foreign person and holds/owns no foreign assets, it qualifies for the inactive entity exemption and does not need to file a BOIR with FinCEN. If you are an owner of an inactive company and are never going to use it again, the best practice would be to actively terminate it with the Secretary of State or Corporation Commission where it was formed. Any company that is terminated by the end of December 31, 2024, has no obligation to file a BOIR with FinCEN.

Exempt companies do not file a BOIR with FinCEN. HOWEVER, be sure you are 100% sure that your company is exempt by consulting with a legal professional. Discuss when and how your company could lose the exemption. You should put policies and procedures in place to monitor your exemption status to ensure that if your exemption status changes, that a BOIR is filed with FinCEN within thirty (30) calendar days of that change.

MAYBE, unless you are otherwise exempt. Prior to the temporary suspension of all CTA deadlines, FinCEN provided guidance on July 8, 2024, that all business entities that were not completely and irrevocably formally dissolved by January 1, 2024, and dissolved during 2024, must still file a BOIR unless they are otherwise exempt. Logically, this extends to any business dissolved between January 1, 2024 and February 19, 2025. Contact us if you have questions.

This means that there is no way to reinstate your business entity with the Corporation Commission or Secretary of State. For example, if an LLC is terminated in the State of Arizona there is no mechanism for it to be reinstated. However, if an Arizona LLC is administratively dissolved, it has six (6) months to reinstate itself to good standing.

No. As of July 8, 2024, this is what FinCEN says, “If a reporting company files an initial beneficial ownership information report and then ceases to exist, then there is no requirement for the reporting company to file an additional report with FinCEN noting that the company has ceased to exist.”

Yes. This is what FinCEN says “if a reporting company was created or registered on or after January 1, 2024, and subsequently ceased to exist, then it is required to report its beneficial ownership information to FinCEN—even if it ceased to exist before its initial beneficial ownership information report was due.”. You will need to get an EIN for your business entity even if you decide to dissolve your business prior to operating. You should obtain a legal opinion to be sure that your business entity was completely and irrevocably dissolved prior to January 1, 2024 before you can be sure that you have no obligations to file a Beneficial Ownership Information Report (BOIR) with FinCEN. It is often not as simple as you think.

It depends. A company that is administratively dissolved or suspended because, for example, it failed to pay a filing fee or comply with any other legal requirement, does not cease to exist as a legal entity unless the dissolution or suspension becomes permanent. In Arizona, corporations that are administratively dissolved may reinstate the corporation for a period of six (6) years, so the administrative dissolution is not permanent until after the reinstatement period has ended. This varies by state. Do not assume that your business is exempt from reporting just because it was administratively dissolved. Contact us so we can be sure you properly comply with the CTA.

Probably not, IF you meet the six-part test to be an inactive entity or are otherwise exempt. If you do not meet the all of the elements required for the inactive entity exemption, you will need to file a BOIR with FinCEN. This may entail applying for an EIN.

Reporting Company Responsibility to Report Company and Ownership Information

The reporting company is responsible for collecting personal identifying information from its beneficial owners and filing the Beneficial Ownership Information Report (BOIR) with FinCEN. However, the beneficial owners are PERSONALLY LIABLE for failure to file the initial BOIR or failure to update that report within thirty (30) calendar days of any change to the initial filing.

The reporting company files the Beneficial Ownership Information Report (BOIR). The reporting company is required to provide its name (including any trade names it uses), address and EIN. The reporting company is also required to provide the personal identifying information of any human owner that has a 25% ownership interest or more in the company as well as any person that has substantial control over company affairs (for example, managers, officers, directors, CEOs, CFOs, etc.).

No. If your business entity does not have an EIN, it may use a business owner’s social security number instead. There is no requirement to obtain an EIN/TIN for the sole purpose of filing a BOIR.

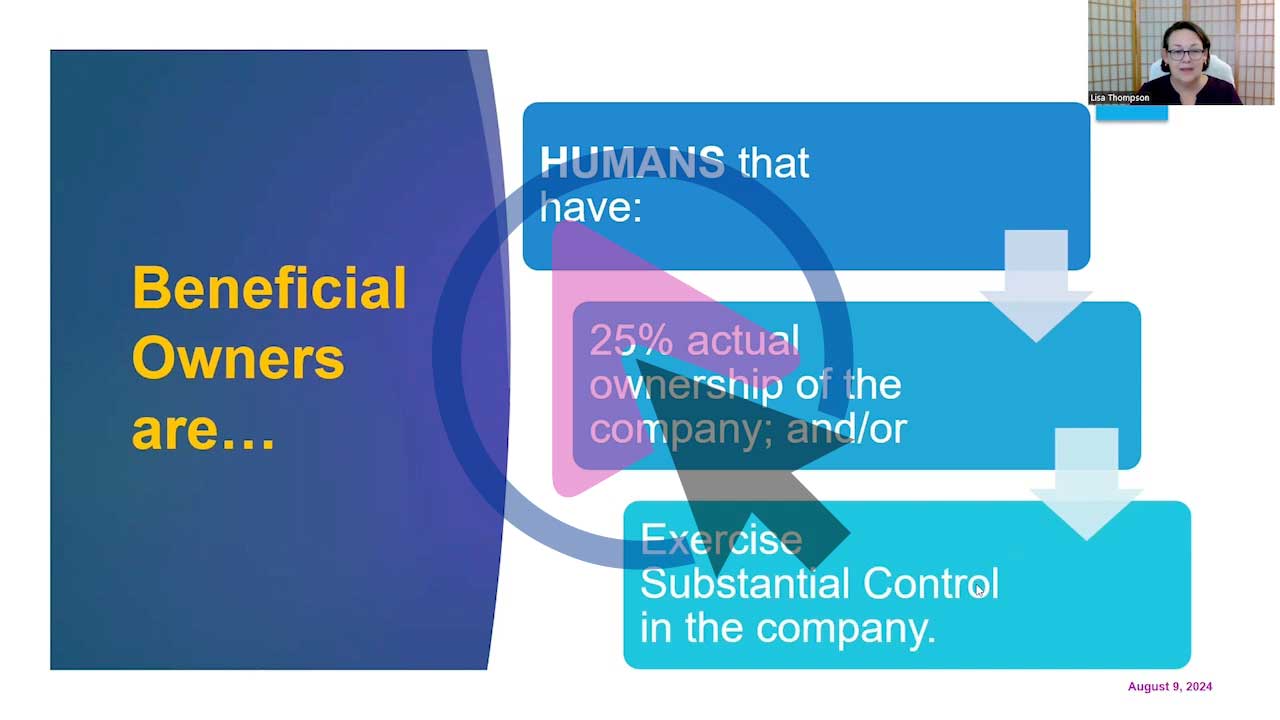

Beneficial Owners Under the Corporate Transparency Act (CTA)

A “beneficial owner” is any human that owns 25% or more of a reporting company or any human that exercises substantial control over the company’s affairs. There are many nuances to this definition, and it may not be as easy as you think. For example, all of the members of a corporation’s Board of Directors may be beneficial owners or not depending on the authority granted to the Board by the corporation’s Bylaws. Also, if an individual has unexercised stock options they may or may not need to be reported. It is important to seek legal advice about who are the true beneficial owners of a domestic or foreign reporting company to be sure that all of the specific circumstances have been analyzed.

Maybe, it depends. Arizona, Nevada and California are community property states so anything your spouse owns, you own unless you have properly taken steps to disclaim business interests. Not all spouses will need to report, but you need to do the legal analysis to make that determination. You should obtain a legal opinion on your specific situation to be sure that you properly comply with the CTA.

If your company is more than 25% owned by a trust, any humans that substantially control of the trust will need to report their personal information on the Beneficial Ownership Information Report (BOIR). This may include the grantor(s), trustee(s) and in some instances the beneficiaries. If the trust is created by filing documents with a Secretary of State or other agency, the trust will have to report as a reporting company as well. In most states, like Arizona, trusts are only private contracts and are not required to report to FinCEN as a reporting company. You need legal advice to ensure proper reporting of a trust as the reporting requirements are fact specific and may vary by state.

If your company is more than 25% owned by another company, the other company will need to report to FinCEN as well unless it is exempt. The CTA is designed to have each company report until such time as a human owner is identified. Please seek legal advice to ensure proper reporting as the reporting requirements are fact specific and vary by business.

No, statutory agents and registered agents have no ownership interest in or control of a company by virtue of being its agent for receiving legal documentation (service of process). Unless the statutory agent or registered agent has 25% or more ownership in or substantial control of the company, they are not included in the BOIR.

Company Applicants Under the Corporate Transparency Act (CTA)

A “Company Applicant” is the individual who directly files the document to create or register the company with the Secretary of State or Corporation Commission; or the person who is primarily responsible for directing or controlling the filing. For example, if a lawyer advises a client to form an LLC and then the lawyer’s paralegal forms the LLC. Both the lawyer and the paralegal are company applicants. This means that both the lawyer and the paralegal will have to provide their personal identifying information to the reporting company they created so it may file its Beneficial Ownership Information Report (BOIR) or they will need to get a FinCEN Identifier to use so they do not have to provide their personal identifying information to a client. Company applicants include ANYONE (like you or your CPA) who files the paperwork to form a business entity (like an LLC). If you form your company yourself, you will need to report yourself as a company applicant as well as a beneficial owner. Only entities formed after January 1, 2024, have to report their Company Applicant(s).

Company Applicants only exist for new companies that formed after January 1, 2024. If your company was formed BEFORE January 1, 2024, you do not have a Company Applicant to report.

Personal Identifying Information (PII) Reported to FinCEN

The reporting company must collect and report the name, date of birth, and residential address of each beneficial owner of the company. It also must submit a copy of the beneficial owner’s non-expired driver’s license or non-expired passport. If the beneficial owner is another company, the reporting company will need to report the human ownership of the company that owns the reporting company. Each reporting company must file its own BOIR (unless exempt) and each BOIR must show human beneficial owners.

You may request a FinCEN Identifier from FinCEN.

A FinCEN Identifier is a unique number FinCEN will provide after you submit all of your Personal Identifying Information (PII) to FinCEN directly. You would provide your FinCEN Identifier in lieu of your PII as a beneficial owner or Company Applicant of a company whenever you are required to report. If you make any changes to your PII used to obtain your FinCEN Identifier, you will only need to update your FinCEN Identifier because it would automatically update your information with all the companies where you are a beneficial owner. The downside to using a FinCEN Identifier is that there is no way to cancel its registration at this time. This means that if you have a FinCEN Identifier, you will have to keep it updated forever or you will be fined $606/day. Still, if you are required to report your PII for multiple businesses it may ease the burden of reporting. Companies may also obtain FinCEN Identifiers, but it makes no sense to get a company FinCEN Identifier unless the company owns other reporting companies.

The U.S. government already has the information you are required to provide. In fact, the U.S. government gave it to you in the first place. The Corporate Transparency Act (CTA) is merely designed to create a database so that law enforcement officials do not have to contact multiple government agencies like the IRS, state Motor Vehicle Departments, the Census Bureau or U.S. Customs and Immigration to obtain the same information that the Beneficial Ownership Information Report (BOIR) requires to be disclosed.

You don’t report the company that owns the business entity, you report its HUMAN owners. The business that owns your reporting company does not have Personal Identifying Information (PII) to report so it must file its own BOIR and your reporting company must report the human beneficial owners of the business that owns your reporting company. It can get complicated. There is a limited exception for subsidiaries that requires a thorough analysis before it may be used. Contact us to ensure proper reporting to FinCEN.

Probably. There might be a short cut for parent/subsidiary reporting, but it is narrow and fact specific. You should speak with an attorney about your specific business structure. You may also consider using a FinCEN identifier for ease of multiple company reporting.

Confidentiality of BOIR Information from the Public

Yes. ABSOLUTELY. Information provided to FinCEN is solely for law enforcement purposes. It is not public and law enforcement may only have access to it, in most cases, by Court Order. Law enforcement officials are also PERSONALLY fined $606/day for any CTA disclosure violation.

Deadlines for Filing Beneficial Ownership Information Reports (BOIRs) and Updates/Corrections

No domestic reporting company has any requirement to comply with the CTA. Nonexempt foreign reporting companies must file their initial BOIR by April 25, 2025. Any nonexempt foreign reporting company created after March 26, 2025 has thirty (30) calendar days from the date of registration to file its initial BOIR.

Any entity formed after February 19, 2025, has thirty (30) days to file its initial BOIR. There are no new businesses that are exempt from the requirements of the CTA at the time of formation.

No domestic reporting company has any requirement to comply with the CTA. Nonexempt foreign reporting companies must file their initial BOIR by April 25, 2025. Any nonexempt foreign reporting company created after March 26, 2025 has thirty (30) calendar days from the date of registration to file its initial BOIR.

If your business is subject to enforcement of the CTA and it made a mistake in its initial BOIR, correct the mistake immediately by filing a corrected BOIR. After April 25, 2025, reporting companies subject to CTA enforcement have thirty (30) calendar days to make any corrections or updates to their reports or they may be subject to $606/day civil fines.

Nonexempt foreign reporting companies subject to CTA enforcement have until April 25, 2025, to correct or update their Beneficial Ownership Information Reports (BOIRs). After April 25, 2025, reporting companies subject to CTA enforcement have thirty (30) calendar days to make any corrections or updates to their reports or they may be subject to $606/day civil fines.

Make the changes to ownership/management and file an updated BOIR within thirty (30) days. If you hire us to file your BOIR, our filing service provides BOIR updating service for a year so you can file your report now to meet the deadline and once the changes have been made to your company we will update your filing (within 30 calendar days of the change). Our service does not require you to upload all the information that you previously have uploaded so you would just upload any new information.

Fines and Penalties for Failure to Report/Update or Make Corrections

Because other companies are not staying current on the law. Federal civil fines were increased on January 17, 2025, as a result of the federal Inflation Act of 1994. Federal monetary civil penalties civil fines are adjusted for inflation annually. The CTA was passed in 2021 so in 2024 the fines were adjusted to $591/day to account for inflation and they were adjusted again in 2025 to $606/day.

This is a new law so who knows how it would be applied to the reporting companies subject to CTA enforcement. The law is clear that civil fines of $606/day will be imposed until the report is filed or the correction made (no limit to these civil penalties) and there is also a criminal fine of up to $10,000 as well as imprisonment for up to two (2) years. These civil and criminal penalties may be imposed on business owners personally.

WRONG!!! The CTA has two types of fines. Civil fines of $606/day until the violation of the CTA is remedied and criminal fines of up to $10,000. The cap is on the criminal fines not the civil fines. A year of civil penalties is $221,190.00.

Bankruptcy is not going to get you out of personal civil fines. These fines are not going to be dischargeable in bankruptcy just like other fines are not. At most, you could file a Chapter 13 bankruptcy and force the payment of the fines over time. It is easy to comply with the CTA and even to hire an attorney to be sure to do it right, why would you do anything else?

Filing Beneficial Ownership Information Reports (BOIRs)

No, you do not need to hire a lawyer to file your Beneficial Ownership Information Report (BOIR) with FinCEN. However, an attorney can guide you in the interpretation of the law and ensure that you file an ACCURATE report. Plus, most lawyers carry malpractice insurance, so you have a remedy if there is an inadvertent mistake. If you file on your own, you are on your own.

All BOIRs are filed electronically at FinCEN’s OFFICIAL website (https://www.fincen.gov/boi). If you Google, BOIR filing you WILL NOT get the FinCEN website and you will have to hunt for it. There are many imposter websites that appear to be the official FinCEN website but are not. If you accidentally get on one of these imposter websites, you will be charged to file your BOIR, and you will only know it after you have inputted your personal information. Filing with FinCEN is free so if you are going to assume the responsibility of filing yourself, do it free of charge. Again, the official FinCEN website is at https://www.fincen.gov/boi.

I was consulting with a client about a business law matter unrelated to the CTA. However, because I am passionate about business owners doing this right and not getting fined, I told her about the CTA. My client said that she had already complied and her CPA had filed it for her. I asked her if her address was the same as what was on her business records with the Corporation Commission. She said no. I asked her if she was married. She said yes. I asked her what address her CPA used on her BOIR. She said that she already knew the BOIR was wrong because the address was incorrect. We discussed her marital situation, and her husband needs to be reported on the BOIR. The CPA never even asked about marital status and used the wrong address for both my client’s residential address and the business entity address. My client asked what she should do. I said that we needed to IMMEDIATELY correct the BOIR as she has thirty (30) calendar days to correct the BOIR. By the time I asked my client about her BOIR, the 30-day deadline to make the correction had passed by 10 days which (in theory) could be an assessment of $5,910.00 in civil fines. I speak with clients all the time and many times I hear the same things. Make no mistake, the CTA is serious. The best thing to do, even if you think your business is exempt from filing a BOIR, is get a written legal opinion on your business’ compliance requirements for the CTA. This is your insurance if you are questioned about your compliance. You had advice of counsel. Whatever you will pay for a written legal opinion specific to your business or to have an attorney file your BOIR will be less than what your civil fines will be if you get it wrong for even two days. Spending the money now saves you thousands in the future.

There is nothing in the CTA that says a CPA (or other authorized individual) cannot file a Beneficial Ownership Information Report (BOIR) for a client, but you do not have lawyers file your taxes so having a CPA file your report may be having them give you legal advice. It is always best practice to have both a CPA/tax professional on your business team. The CPA/tax professional should only give you tax advice and the attorney should advise you on business law (which includes CTA compliance).

You should always seek legal advice on your particular circumstances and business. If your Beneficial Ownership information Report (BOIR) has already been filed and you have not spoken with an attorney, you should seek legal advice quickly. If your BOIR is incorrect, you have thirty (30) calendar days to fix it or you, your other beneficial owners and your company may be fined $606/day in addition to other criminal penalties that may be assessed. You will not know that your BOIR is incorrect until sometime in the future if it ever comes up. Think IRS audit. You file your taxes and assume they are correct, but years later you get audited and find out they were wrong. Same thing here. The only difference is the $606/day fine for failing to have an inaccurate report for years and years.

The reporting requirements for reporting companies VARY BY STATE. To date, I have not seen a Beneficial Ownership Information Report (BOIR) questionnaire that encompasses all the nuances of each state and the pitfalls that may be lurking in your state’s laws. For example, I have not seen a questionnaire from a third-party filer that asks business owners in community property states if they are married and if they are, any of the follow up questions necessary to determine if your spouse should be included in your BOIR.

Yes, while I am only licensed in Arizona, California or Nevada, I will ensure that we have the opinion of an attorney in the state where your business is formed to ensure that you are exempt/not exempt from CTA reporting and including the beneficial owners required by the laws of the state where your business entity was formed.

Yes, you can file the BOIR yourself. But, think about this, how do you feel when someone says that they are going to do what your business does themselves? Do you curse YouTube and Google? Do you think that is a bad idea because your customer really needs an expert like you? In a sense it is the same with filing a BOIR. The act of filing the BOIR by the deadline is relatively easy. However, the bigger deal is ensuring it is accurate and including everything that should be in it. Also, it is important to be sure that you know the ongoing reporting requirements and have a system to ensure that you do not miss them. We are happy to advise you on what you need to report in your BOIR and analyze your beneficial owners. We do not have to file the report for you. You can file the report yourself to save a few dollars if you would like.

How Will I Know My BOIR is Accurate

You won’t until it is too late. Think IRS audit. You filed your taxes. Great, all done, whew, then many years later you get a notice of an audit. This is the same thing. Having your report filed by deadline is the first step, but the next is making sure it is accurate. You won’t know until it is too late and after $606/day in fines have accrued (possibly for years). This is why it is so CRITICAL that YOU ensure that your report is done correctly now.

Paying a legal professional to file your BOIR ensures that it is accurate and timely (based on the information you provide). Also, some law firms (like us) keep all of the beneficial owner’s information confidential from the other beneficial owners. Any legal fees you pay are a tax deduction for professional services. Hiring an attorney to handle your BOIR filing is like getting Corporate Transparency Act insurance. If you have a written legal opinion about your business filing requirements (even if you are exempt) you have acted on the advice of counsel. You may also choose to file the report yourself if you want to save the cost of the actual filing once you have the correct information you need to report.

We take a holistic approach to your business. It does you no good to have an accurate Beneficial Ownership Information Report (BOIR) and not have your public records match or be incorrect. Our service provides you a written legal opinion detailing your reporting and exemption status as well as who are your business entity’s beneficial owners that need to be included in your BOIR. In addition, we will review the public records at the Corporation Commission and the Secretary of State to verify that they are accurate based on the information you provided in your CTA questionnaire. We will make recommendations for corrections and changes that should be made or considered. If you want us to file your BOIR, we are happy to do so (choose the silver package). If not, we will give you the deadlines for filing your BOIR and the instructions for doing so yourself. You are not just getting CTA analysis for your business, but a complete business check-up of your public records to ensure that everything is accurate and up-to-date and if not, recommendations for what we should do to fix them. If FinCEN ever reviews your BOIR, you want to be sure that everything reported to any government agency is in alignment. The added bonus is that this helps protect your corporate veil because it is maintaining a corporate formality that allows your personal assets to be safe from creditors.

First, are you sure your records with the Corporation Commission and/or the Secretary of State are accurate? Second, a written report from an attorney is just a verification that you are all in compliance. In addition, we will make recommendations as to other structural or substantive changes you may want to consider.

YES, we are able to offer bulk pricing. Contact us and let us know that you have multiple LLCs. We will give you a quote.

Save your money and do it yourself. All you are getting is the act of filing your BOIR based on a questionnaire. You are not getting a written legal opinion on what should be contained in your BOIR. If your BOIR is filed wrong, you likely have no recourse against your filer and you will be paying the civil fines of $606/day that may be imposed. It is just like you did it yourself and you are likely on your own. My legal fees are typically less than two days of fines for getting it wrong and I have your back if something goes wrong. Legal fees are a tax deduction for professional services as well. Like it or hate it, CTA compliance is now an additional cost of doing business.

Because you have a written report that you may rely on, and it took time and expertise to ensure that you are getting accurate information on your specific situation. My favorite doctor’s appointment is when I go to my doctor, and he/she says that I am perfectly fine. I happily pay that bill. I also pay for medical insurance in the hopes that I don’t need it. Blessedly, I use it rarely, but I am glad I have it when I do. Your written report about your business entity’s compliance requirements under the CTA is your CTA insurance.

Because you have a written report that you may rely on, and it took time and expertise to ensure that you are getting accurate information on your specific situation. My favorite doctor’s appointment is when I go to my doctor, and he/she says that I am perfectly fine. I happily pay that bill. I also pay for medical insurance in the hopes that I don’t need it. Blessedly, I use it rarely, but I am glad I have it when I do. Your written report about your business entity’s compliance requirements under the CTA is your CTA insurance.

Mandatory Updates to Beneficial Ownership Information Reports (BOIRs)

Any time the information that has been previously reported to FinCEN changes, the reporting company has thirty (30) calendar days to report the change or civil fines of $606/day may be imposed against the company and its beneficial owners personally. In addition, criminal penalties of up to $10,000 in a criminal fine and up to two (2) years imprisonment may be imposed on beneficial owners. All companies should have a policy to monitor changes in BOIR information to ensure that these deadlines are not missed.

No. This is not an annual registration. However, any time a beneficial owner changes his/her address or renews a passport/driver’s license the reporting company has thirty (30) calendar days to report that change to FinCEN. If the company changes its address or any of the information it has provided to FinCEN, those changes must be reported to FinCEN within thirty (30) calendar days. If not, civil fines are incurred at $606/day with no end against the beneficial owners personally until the change has been made.

No. As of July 8, 2024, this is what FinCEN says, “If a reporting company files an initial beneficial ownership information report and then ceases to exist, then there is no requirement for the reporting company to file an additional report with FinCEN noting that the company has ceased to exist.”

Maybe, it depends. Your new spouse may not have to report now, but maybe will have to report later. Also, you may want to consider disclaimers to make it clear that your new spouse has no interest in your existing business. All internal governance documents should also make clear the business owner’s spouse’s interest (if any) in the company. You should seek legal advice.

Maybe, it depends. Your ex-spouse may not have reported on your BOIR in which case there is no change to report, but if your ex-spouse was part of the BOIR, it must be updated within thirty (30) calendar days of any change or $606/day civil fines may accrue against you and your former spouse. The question really will become when did the change occur and when will the 30-calendar day deadline clock start ticking (time of divorce? Time the records are changed with government agencies?, etc.). You should seek legal advice.

No. There is no annual reporting requirement to FinCEN. However, if any of your beneficial owners, move, renew their driver’s license or passport OR if the business makes changes to its trade name, location or other information reported to FinCEN, those changes must be reported within thirty (30) days of the change or civil fines of $606/day may be imposed on the business owners personally as well as the company. Criminal penalties of up to a $10,000 criminal fine and up to two (2) years imprisonment may also be imposed.

Yes. The question as to when the change must be reported to FinCEN. Seek legal counsel to make sure you do not miss the deadline to report the new beneficial owner which will likely be the heir(s) or the deceased owner.

Best Practices to Maintain Compliance

YES, but there is no requirement to do so. I think it makes sense to include a written CTA Compliance Policy in all company governance documents to show a company’s commitment to CTA compliance. It may even be a good practice to have a separate stand-alone policy as added evidence of a company’s commitment to CTA compliance. Let’s face it, there will be mistakes in remembering to report changes, etc. so I think it is best to have policies in place to show that in the event of a mistake that the company has a demonstrated commitment to complying with the law as shown in its written policies. This might not get you out of fines, but it may limit them, and it can’t hurt. You may also want to include language in your company’s governance documents to penalize beneficial owners who fail to notify the company of any changes in their personal identifying information that causes the company or its other beneficial owners to be fined.

Have a compliance officer tasked with periodically asking beneficial owners about any changes to their personal identifying information. Educate your beneficial owners on when they need to notify the company of changes. Build in policies so that it is clear when a change needs to be reported and consider having penalties in your company governing documents for failure to notify management of a change. If you know when your beneficial owner’s passports or driver’s licenses are going to be renewed, put in a tickler in your electronic calendar before that date to remind yourself to update the BOIR within thirty (30) calendar days of the change.

Yes, it would be a best practice to have a formal written compliance policy. There is only one slim safe harbor in the CTA for businesses that correct a mistake in a BOIR report within thirty (30) calendar days of discovering the mistake and within ninety (90) calendar days of the original filing of the report. There is no other grace period. Beneficial owners are personally liable for the reporting of their information to FinCEN. This is no time for owners to delegate to untrained staff. It is perfectly appropriate to task company personnel with monitoring CTA Compliance, but they need to be trained and there needs to be clear procedures in place detailing the company’s commitment to compliance with the CTA. If the company makes a reporting mistake, it may help that it maintained a CTA Compliance Policy and training program. Alternatively, hopefully, having a CTA Compliance Policy and training program will avoid the imposition of any fines against the beneficial owners for failure to report.

How Will I Know That My Business Needs to File a Report

NO!!! You will NOT receive a text, email, letter, or phone call from FinCEN telling you to file a report. If you do, it is a SCAM. The IRS does not send notices out to anyone as a reminder to file annual tax returns and neither does FinCEN contact businesses about their requirements under the CTA. If you have questions about whether your business needs to file a BOIR with FinCEN contact an attorney immediately, so you do not miss any deadlines.

If you receive an email, text, letter, or phone call about CTA reporting, it is either a scam or an advertisement from a third-party filer. FinCEN is NOT sending notices or reminders about CTA reporting to business owners. Do not provide information to anyone over the phone, by text or email unless you have verified who they are. Also be sure to use the official FinCEN website for any BOIR filings (https://www.fincen.gov/boi). For a sample of a mailed scam notice, click here.

The Corporate Transparency Act (CTA) is a new U.S. law, and it is up to everyone to pass along the information. If you would like us to make a presentation with the most up-to-date information on the CTA for your business organization, let us know and we can make it happen if we have availability. You may also watch any of our free webinars or videos.

Businesses Outside of the U.S./Foreign Businesses

It depends. If your foreign business was formed under the laws of a foreign country (or U.S. Territory) and has registered to do business in the U.S. by filing a document with a Corporation Commission or Secretary of State in the U.S., it is a reporting company and must comply with the Corporate Transparency Act (CTA). However, it may be exempt if it qualifies for one of the 23 exemptions under the CTA. You should seek legal advice.

A foreign reporting company is any business entity (including a corporation or LLC) formed under the law of a foreign country that have registered to do business in the U.S. by the filing of a document with a Secretary of State or any similar office. If the foreign company is not required to register to do business where it is doing business in the U.S., it is not a reporting company. However, most states require that non-U.S. companies register to do business in the state in order for them to legally do so. Foreign reporting companies must also comply with the CTA unless they are otherwise exempt.

No, the requirements for filing a Beneficial Ownership Information Report (BOIR) with FinCEN are exactly the same for domestic and foreign reporting companies. However, the Personal Identifying Information (PII) of the foreign reporting company’s owners may be slightly different.

YES!!! SÍ!!! OUI!!! JA!!! DA!!! HAI!!! CÓ!!! OO NGA!! We have interpretive services for almost any language. When you contact us for a consultation, please provide the language you require. There may be a slight surcharge for the costs of interpretation, but we will be sure that you get the information you need in the language you prefer and understand.

All foreign reporting companies have until March 21, 2025 to file their initial Beneficial Ownership Information Reports (BOIRs). After March 21, 2025, every business has thirty (30) days to make any corrections or updates to their reports after they happen or they may be subject to $606USD/day fines.

Any updates or corrections to Beneficial Ownership Information Reports (BOIRs) must be made within thirty (30) days of the change. Any new entity or foreign company that registers to do business in a state in the U.S. has thirty (30) days from the date of registration to file its initial BOIR.

First, if you have an address of a primary location where your company does business in the U.S., use that address. If you do not have a primary location in the U.S. and your company does business at many locations in the U.S., use one of the addresses at a location where your company does business in the U.S. and receives important correspondence. If your company has no physical location where it does business in the U.S., use the address of the company’s statutory agent or registered agent.

You may use your foreign Taxpayer Identification Number (TIN) for your foreign business entity’s Beneficial Ownership Information Report (BOIR). If you do not have a foreign TIN, you may use a business owner’s U.S. TIN or apply for an Employer Identification Number (EIN)/Taxpayer Identification Number (TIN) IMMEDIATELY. This is the number that U.S. businesses use to identify themselves with the U.S. Department of Treasury (and the Internal Revenue Service). Your business owner(s) may also need to apply for an Individual Taxpayer Identification Number (ITIN) to obtain an EIN. This must be done IMMEDIATELY as the Application for ITIN must be submitted in writing by mail, and it takes 6 to 8 weeks to receive the tax identification number. FinCEN is NOT making exceptions to the CTA filing requirements for businesses that have not received their ITINs or Employer Identification Numbers (EINs) by the filing deadline. Consult a qualified CPA if you have any questions regarding ITINs and EINs for foreigners and their businesses. For more information on Individual Taxpayer Identification Numbers (ITINs), go to https://www.irs.gov/individuals/international-taxpayers/taxpayer-identification-numbers-tin or https://www.irs.gov/individuals/international-taxpayers/obtaining-an-itin-from-abroad for information on obtaining an ITIN from abroad. Foreign reporting companies that are not subject to U.S. corporate income tax may report a foreign tax identification number and the name of the relevant jurisdiction instead of a U.S. federal EIN or TIN.

The Corporate Transparency Act (CTA) is a new U.S. law, and it is up to everyone to pass along the information. FinCEN has written many guides in different languages to help foreign reporting companies. You can visit https://www.fincen.gov/boi/small-entity-compliance-guide for some of the small business guides that have been translated into other languages. We have provided these reports on our website as well. If you would like us to make a presentation with the most up-to-date information on the CTA for an organization in your country in YOUR language, let us know and we can make it happen if we are available.

Video Resources

What YOU Need to Know About the Corporate Transparency Act (CTA) AS OF MARCH 3, 2025

March 3, 2025 – 1 hour

ALL BUSINESSES FORMED OR DISSOLVED prior to February 19, 2025 that are subject to CTA enforcement may need to file a Beneficial Ownership Information Report (BOIR) or determine that they are exempt. With the March 21, 2025 deadline looming, this seminar will discuss what you need to know so that your business complies with the Corporate Transparency Act (CTA). Nonexempt foreign reporting companies are subject to enforcement of the CTA and MUST meet the April 25, 2025 deadline. (March 3, 2025, 1 hour, YouTube)

CYA from the CTA 2.0: An update on Corporate Transparency Act Compliance Requirements

August 9, 2024 – 1 hour, 18 minutes

The Video provided below remains accurate as to the mechanics of CTA filing and analysis of the law. Any mention of deadlines should be disregarded.

PLEASE MAKE NOTE that even though this video was created in August 2024 the information is accurate except with deadlines. This video should only be used to learn how to file a Beneficial Ownership Information Report (BOIR), what the BOIR should contain and general information on the CTA. (1 hour, 18 minutes, YouTube)

CTA UPDATE AS OF JANUARY 3, 3025 – What is going on???

January 3, 2024 – 1 Hour – AZLegalTalks

Articles

The Articles provided below were published prior to the changes in the enforcement of the CTA. They should be used for information about the requirements of the law as those remain accurate, but any filing deadlines mentioned should be disregarded. The new deadline for mandatory CTA reporting deadline for nonexempt foreign reporting companies is April 25, 2025.

FinCEN Small Entity Compliance Guides

Below you will find the official FinCEN Small Entity Compliance Guides in other languages. Keep in mind that FinCEN updated its guidance multiple times in 2024 so these guides are not completely accurate, but they are the most recent we have. We have also posted the most recent Frequently Asked Questions (FAQs) that were written in July 2024. If you need assistance, contact us, we have a service that can translate any language so we can communicate.

- English (English) (December 2023)

English FAQs (November 2024) - Español (Spanish) (September 2023)

Español FAQs (July 2024) - 中文简体 (Chinese Simplified) (September 2023)

中文简体 FAQs (July 2024) - 中文繁軆 (Chinese Traditional) (September 2023)

中文繁軆 FAQs (July 2024) - Tiếng Việt (Vietnamese) (September 2023)

Tiếng Việt FAQs (July 2024) - 한국인 (Korean) (September 2023)

한국인 FAQs (July 2024) - Tagalog (Tagalog) (September 2023)

Tagalog FAQs (July 2024) - Português (Portuguese) (September 2023)

Português FAQs (July 2024) - Français (French) (September 2023)

Français FAQs (July 2024) - Русский (Russian) (September 2023)

Русский FAQs (July 2024) - Kreyòl ayisyen (Haitian Creole) (September 2023)

Kreyòl ayisyen FAQs (July 2024) - عربي (Arabic) (September 2023)

عربي FAQs (July 2024) - हिन्दी FAQs (July 2024)

The information provided in this website is meant only as a general description of the current laws as of the date of the writing. It is not meant to be an exhaustive discussion of all the nuances of the law and is intended to be only an overview. Many issues may appear simpler than they are, and an individual should always contact an attorney to obtain a complete, accurate interpretation of the law given the individual's particular circumstances. Thompson Law Group, P.C. makes no representations as to how the law would affect a particular situation and intends only to illustrate areas of concern and give general information.